Empower Clinics Inc| Business Overview| Stock Price

Empower Clinics Inc is one of the best operators and regulators of medical fitness and wealth centers in the United States and Canada. Empower Clinics Inc was founded in 2015. The head office of this company is located in Vancouver, Canada. Their work is based on integrated healthcare regarding body and mind wellness. The vision of this company is to deal with both prevention and problems and to treat worldwide patients with conventional and alternative medicines.

Moreover, the company is based on well-organized members loyal to fulfilling the organizational goals. They all are dedicated to performing their tasks with high efficiency. Besides covering the healthcare, finance, technology, and capital markets, Empower Clinics holds excellent and diverse leadership. Therefore, this international firm deals with more than 200,000 patients in the United States and Canada.

Business Overview:

Empower Clinics ethically runs its business and covers the market core segmentation with a massive offering of EPWCF Stock. This company is expanding rapidly and growing its business by making success. Hence, the Empower Clinic is growing forward and engaged in a rollout strategy focusing on maintaining its growth in the UK and Canada.

Besides this, it contributes a lot to the economy of commercial and industrial sectors. It is changing the shape of medical and technological services by focusing on the patient first integrated health and fitness. Hence, by fulfilling all the needs and requirements of patients, this company aims to provide quality products and services with the vigilance of paramedical expert staff.

EPWCF Stock:

If you are considering investing in the EPWCF Stock and want to explore more about it, then you are at the best place. So, continue reading this masterpiece and get all the desired information regarding the outstanding stock of Empower Clinics Inc.

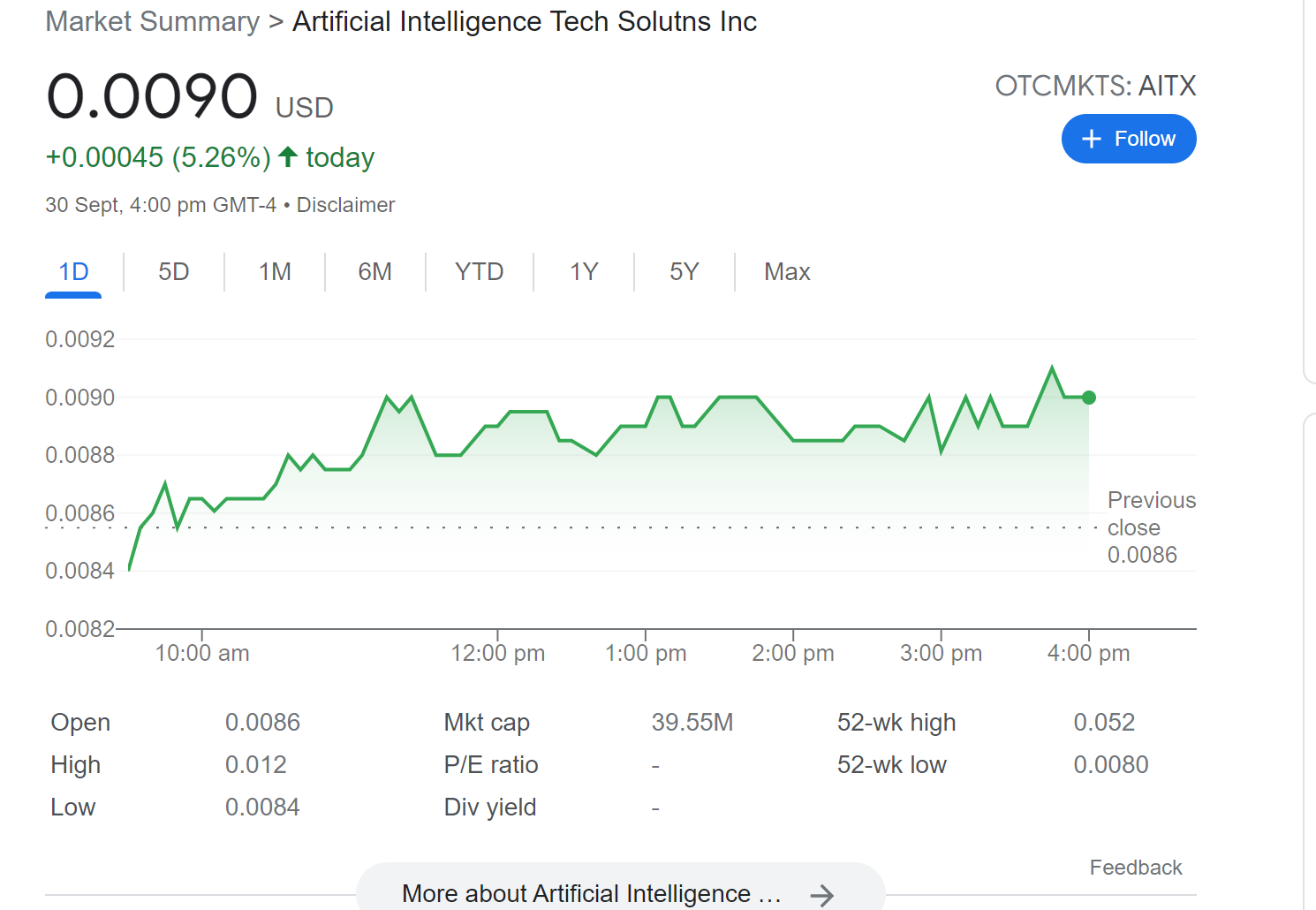

Current Stock Prices:

The current value of EPWFC Stock is 0.066 US dollars. In the recent Five days, the stock's price was 0.078 US dollars on July 1, 2022. And it was 0.070 US dollars on July 7, 2022.

Stock Volatility Or Stability:

The EPWCF Stock is highly stable with a rate of 55.80 US Dollars on September 1, 2000. The price was 52.70 US dollars on September 22, 2000. Moreover, some other dates where the stock is highly stable are given below:

· October 6, 2000

· September 15, 2000

· August 18, 2000

· August 4, 2000

Maximum Stock Price In the Last Five Years:

The maximum price of EPWCF in the last five years was 55.80 US Dollars on September 1, 2000.

Minimum Stock Price In The Last Five Years:

The last five years' minimum stock price was 0.090 US dollars on April 29, 2022.

Financial Statements Analysis

By looking at the financial growth of Empower clinics, you will learn more about this company's earnings, revenues, and assets. Hence, the economic analysis of any company allows you to know about the financial conditions and achievements regarding all the business activities.

Therefore, the financial statement analysis of this company is given below. Let's have a look at that.

Earnings:

This company's earnings have declined by 69.1% over the past five years. There is a rapid decrease in the earnings graph. The payments are 4.302 Million US Dollars in 2020 and 17.066 Million US dollars in 2021.

Revenues:

The revenues declined from the year 2017 to 20221. Therefore, the graph shows a sudden decrease. Hence, the payments at the end of the year 2021 are 38.669 Million US dollars, while the revenues are 1.592 Million US Dollars.

Debt To Equity Ratio:

The debt to equity ratio increased to 61.2% at the end of 2021, and the obligation to equity ratio was -63.5% in 2017. Moreover, the value of equity ratio is 2.913 Million US Dollars in the year 2021.

Liabilities:

All the short-term liabilities range from 3.67 Million US Dollars, and the long-term penalties range to 5.54 Million US dollars.

Assets:

All the long-term assets are worth 8.36 Million US dollars, which exceeds the long-term liabilities. Moreover, all the short-term investments worth 3.7 Million US dollars cover the short-term liabilities.

Comments