RECONAFRICA ANNOUNCES APPOINTMENT OF CORPORATE SECRETARY

Reconnaissance Africa is very pleased to announce the appointment of Michelle Borthwick for the position of Corporate Secretary. The company announces that Ms. Borthwick is corporate finance and governance professional with unending support and advice to the various Canadian general public listed companies.

In the Toronto Stock Exchange, the Canadian Securities Exchange, and the multiple OTC Markets, she is the founder and the principal of Peakshore Counseling Incorporations. Since January 2013, she has been the vice president at several companies.

She also plays her role as corporate finance of Fiore management, and the advisory group also added to this company. Before that, she was the only vice president and corporate secretary of the endeavor mining corporation.

About Recon Africa:

ReconAfrica is a Canadian oil and gas company engaged in the opening of the newly discovered deep Kavango Sedimentary Basin in the Kalahari Desert of northeastern Namibia and northwestern Botswana.

Besides this, the company also presents the RECAF Stock and holds the petroleum license comprising approximately 8.5 million contiguous acres. In addition to this, Recon Africa is committed to the minimum distribution of the habitat with the best international standards and implementation of the environmental and all social factors.

The business activities of Reconnaissance Energy are led by a team of efficient directors and officers. They all have extensive experience with African resource exploration and development. The company is engaged in drilling conventional wells in a low-impact 2D seismic program.

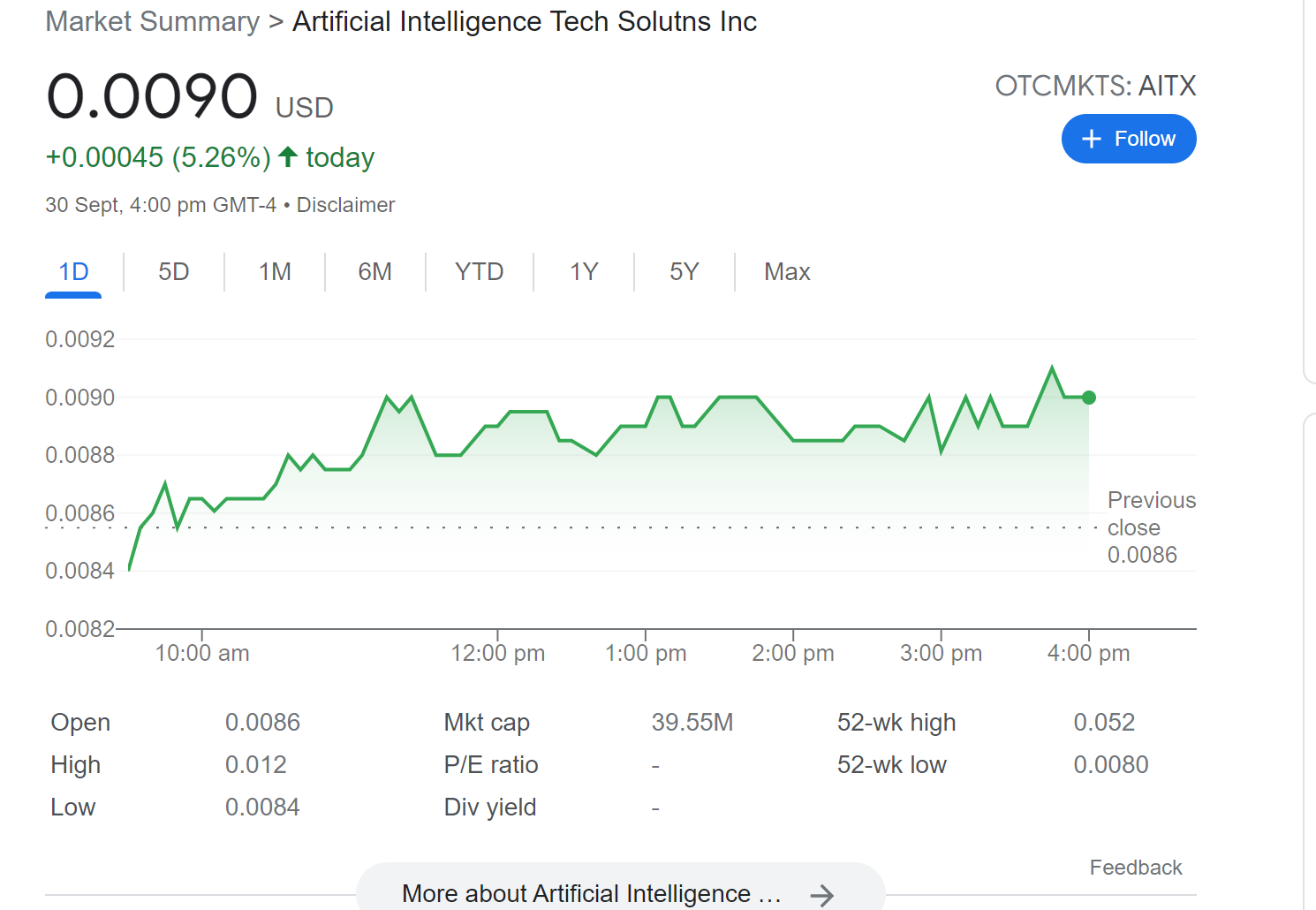

About RECAF Stock:

The current price of RECAF Stock is 4.00 US dollars on July 7, 2022. In the previous five days, the price was maximum with a rate of 4.50 US dollars on June 29, 2022. It decreased to 3.86 US dollars on June 30, 2022.

The financial statements analysis shows that the debt to equity ratio gradually reduces from the end of the year 2019. First, it was 5.6% at the end of 2019, and it reduced to 0% in the year 2022. Hence, the debt to equity ratio is 95.99 Million US dollars.

Comments

Post a Comment